Category: Finance & Economy

-

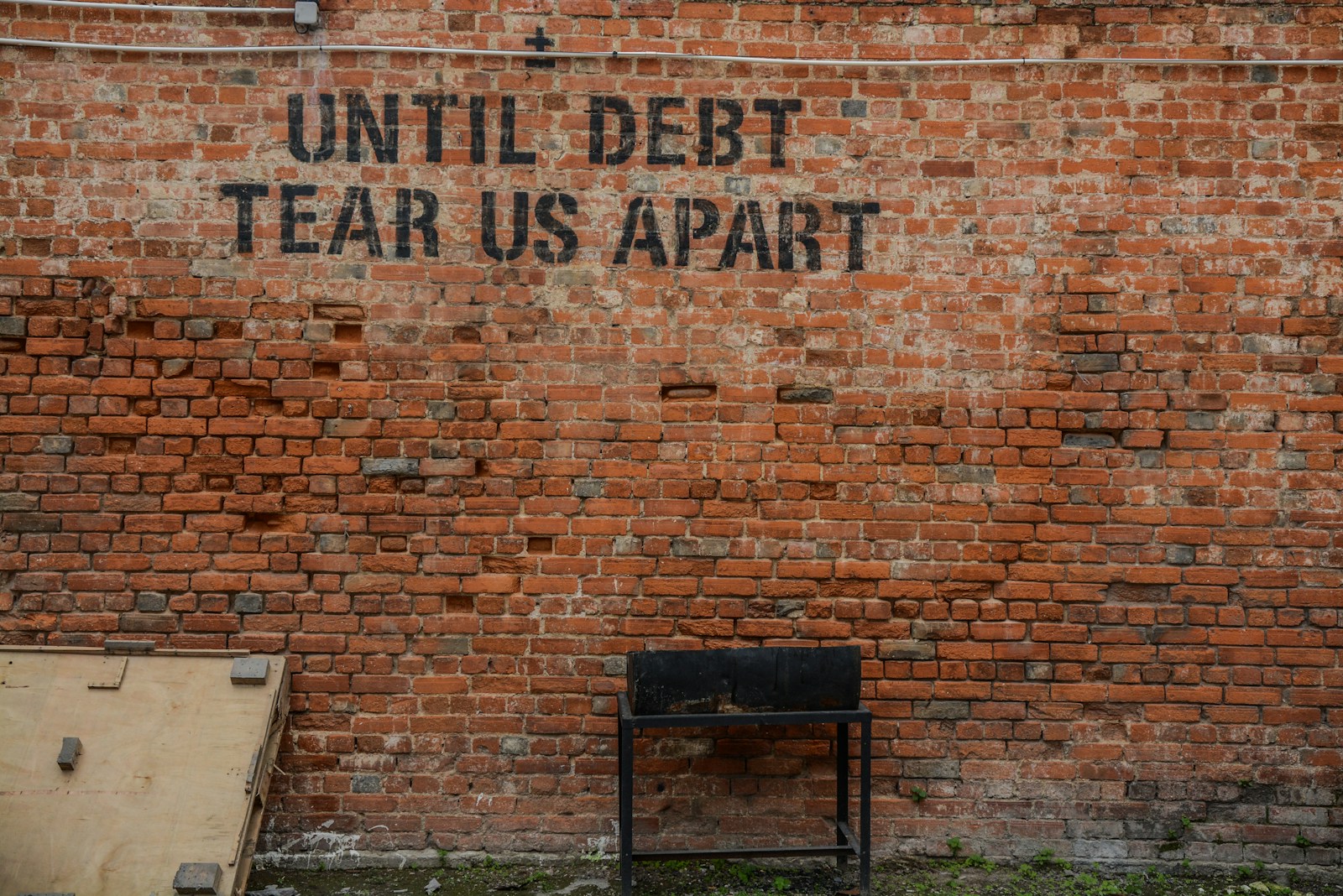

Understanding Sovereign Debt Crises: Causes, Consequences, and Solutions

Introduction A sovereign debt crisis occurs when a country is unable to repay its government debt. This happens when a nation’s financial obligations exceed its capacity to meet them, leading to defaults, renegotiations, or restructuring of debt. These crises can lead to severe economic and social consequences for the affected country, including recessions, unemployment, inflation,…

-

Deep Value Investing: A Surgical Analysis of the Business

Introduction Deep value investing is an approach that targets stocks trading significantly below their intrinsic value. Unlike general value investing, which focuses on stocks that seem undervalued by the market based on traditional metrics like price-to-earnings (P/E) ratio or price-to-book (P/B) ratio, deep value investing zeroes in on companies that are trading at severe discounts,…