Introduction

Arbitrage Pricing Theory, commonly known as APT, is an influential financial theory developed by economist Stephen Ross in the 1970s. It serves as a framework for understanding and predicting asset returns in financial markets by connecting them to various economic factors. Unlike the Capital Asset Pricing Model (CAPM), which only considers one factor (market risk), APT allows multiple factors to influence asset returns, making it a more flexible model.

Let’s break down APT into simpler terms and understand its components, assumptions, and applications.

1. Core Idea of Arbitrage Pricing Theory (APT)

At its heart, APT assumes that an asset’s return is influenced by multiple economic factors, such as inflation, interest rates, and even political events. APT states that these factors create opportunities for “arbitrage”—the practice of buying and selling assets to make risk-free profits when prices differ across markets or assets.

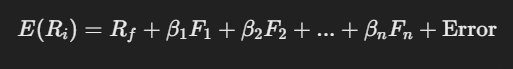

The formula for APT can be expressed as:

Where:

In simpler terms, APT suggests that asset returns are a mix of returns from the risk-free rate and the asset’s responses to different economic factors.

2. Assumptions of APT

APT relies on a few key assumptions:

- No Arbitrage Condition: Investors will quickly act on any arbitrage opportunities (price differences), which drives the market back to equilibrium.

- Linear Relationship: Asset returns are linearly related to various factors. This means that a change in any factor will cause a proportional change in the asset’s return.

- Efficient Markets: Prices of assets adjust rapidly to new information, ensuring that any profit opportunities from arbitrage are temporary.

These assumptions create a structured environment where APT can effectively predict returns and help investors identify profitable opportunities.

3. Factors Influencing APT

Unlike CAPM, which considers only market risk, APT acknowledges multiple factors that could influence returns. These factors might include:

- Macroeconomic Factors: Inflation rates, GDP growth, interest rates, or political events.

- Industry-Specific Factors: Regulations, technological advances, and consumer preferences impacting specific industries.

- Statistical Factors: Variables that are often identified through statistical models, which capture different types of risks not specific to one industry or country.

Each factor has a factor sensitivity, known as (\beta), which measures how much that factor impacts the return of an asset. For example, if interest rates change significantly, financial stocks may respond more strongly than other industries, so financial stocks would have a higher sensitivity ((\beta)) to interest rate changes.

4. How APT Works in Practice

To apply APT, investors or analysts typically:

- Identify Relevant Factors: Determine which economic or market-specific factors are likely to impact the asset’s return. For example, an analyst might consider factors like oil prices for an energy company or consumer sentiment for retail stocks.

- Estimate Factor Sensitivities (Betas): Use historical data to calculate each asset’s sensitivity to these factors. High sensitivity to a factor means the asset’s return is more impacted by changes in that factor.

- Calculate Expected Return: Use the APT formula to estimate the expected return based on the risk-free rate and the identified factors.

Through this, investors can estimate the expected return of an asset and make investment decisions based on whether the asset’s price aligns with its expected return.

5. Benefits of Using APT

- Flexibility: APT allows for multiple factors, making it more adaptable to different market conditions.

- Customizable for Different Assets: APT can be tailored for industries or assets with unique sensitivities to specific factors.

- More Comprehensive than CAPM: By including several factors, APT provides a broader view of the risks and potential returns associated with an asset.

6. Limitations of APT

- Difficult to Identify Factors: Identifying the right factors and accurately measuring them can be challenging.

- Model Complexity: Calculating factor sensitivities and expected returns requires advanced statistical methods, making APT more complex than CAPM.

- No Guarantee of Factor Stability: Factors and their sensitivities can change over time, reducing the reliability of the model in some cases.

7. Applications of APT

APT is primarily used by investment analysts, portfolio managers, and economists to:

- Price Assets: By evaluating the effect of multiple factors, investors can assess whether an asset is overvalued or undervalued.

- Risk Management: Investors can better manage risk by understanding which factors influence their portfolio and adjusting accordingly.

- Arbitrage Opportunities: APT allows investors to identify mispriced assets and take advantage of arbitrage opportunities to make risk-free profits.

Conclusion

In conclusion, APT offers a sophisticated approach to understanding asset returns by acknowledging multiple influencing factors, providing flexibility beyond traditional models like CAPM. While it involves complex calculations and the need for accurate factor identification, APT is valuable for those looking to make informed investment decisions in a multifaceted economic landscape.

Leave a Reply